This past week the Washington Post reported (via Investors Business Daily) on another sad reality facing us in this depressing Obamaconomy:

One out of four U.S. workers with 401(k) retirement savings accounts has been forced to cash them out or borrow from them at high costs just to stay solvent.

Poor money management skills? Not really.

In a June 11th article about declining personal net worth, Mr.ToughMoneyLove explained:

The bursting of the housing bubble caused 75% of this decline. There is lots of blame to go around for this. Congress and its “home ownership for all” mentality. Freddie and Fannie’s lack of reasonable underwriting standards. The big banks. And homeowners who became speculators and gamblers via the act of purchasing something that they could not afford if economic conditions changed.

The resulting fallout; disappearing jobs, and

… millions of Americans, caught between flat wages and high expenses for everything from sending children to college to making home repairs, feel as though they have little choice. The (401k) withdrawals have grown substantially in the wake of the financial crisis.

[Source: Washington Post]

Also a factor; well-founded concern over the insatiable gluttons in D.C. ~

Congressional Democrats constantly threaten to expropriate 401(k)s and replace them with Argentine-style “guaranteed retirement accounts.” Alarmed savers on Internet financial bulletin boards have started talking of emptying their 401(k)s as a defense.

[Source: IBD editorial]

~~~~~~~~~~~~~~~~~~~~~~~~

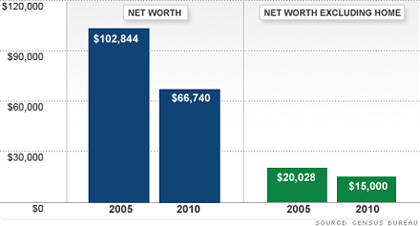

Unfortunately, it’s a Catch-22 situation – skimming from retirement savings inevitably exacerbates the problem. And the reduction of individual net worth is already a major concern, as CNN Money reported earlier this year: Wealth implosion: It’s not just housing ~

Wealth: It’s not getting redistributed – it’s disappearing!

Median household net worth is now comparable to what it was in 1984.

And with Obamanomics firmly in place for another four years, this figure will only decline further: President Obama’s Cat-Food Future For Retirees ~

… (401k) withdrawals have drained $70 billion, or an astonishing near-quarter of the total $293 billion, in America’s retirement accounts “undermining already shaky retirement security for millions of Americans.”

And the timing couldn’t be much worse , because the feds themselves have been raiding the national “retirement” fund for decades ~

…new retirees will outlive Social Security’s official trust fund, a bankruptcy that will force a 25% cut in benefits.

Some 69% of retired workers already are dependent in “major” part on Social Security as their main retirement income, according to a 2012 study by the Employee Benefit Research Institute, with worker savings off sharply for those in the below-$35,000 income bracket.

The Investors’ Business Daily editorial summarizes:

(T)he problem isn’t financially foolish workers. It’s bad policies that make the problems worse. And none of this is being discussed rationally in Washington.

Even so, as sure as the sun will rise, it’s a coming disaster for millions of people in America who will spend their retirements in shocking poverty.

Better stock up on the cat food before the other shoe drops and runaway inflation kicks in.

~~~~~~~~~~~~~~~~~~~~~~~~

Related:

Tough Money Love ~ No-nonsense $$ advice; how the big picture affects your wallet and what to do about it ~ The Hard Truth about Money and Personal Finance