Coincidentally Tax Freedom Day 2012 arrives on the very same day our taxes are due this year. Whoope-dee-do! And of course it comes four days later than last year thanks to higher federal income and corporate tax collections.

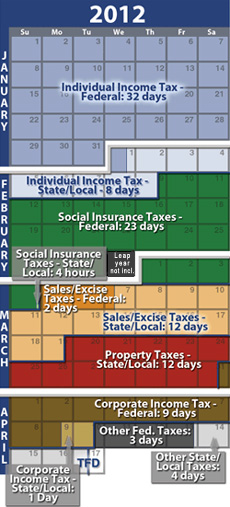

The actual date for Tax Freedom Day is determined by calculating how long, on average, we have to work each year to pay our fair share of combined federal, state and local taxes:

The actual date for Tax Freedom Day is determined by calculating how long, on average, we have to work each year to pay our fair share of combined federal, state and local taxes:

When the nation has finally earned enough to pay all the taxes that will be due for that year, Tax Freedom Day has arrived. This year, Americans will pay $2.62 trillion in federal taxes and $1.42 trillion in state-local taxes, for a total tax bill of 29.2 percent.

Put another way, as Heritage Foundation explains, for the first 111 days of the year, everything you earned went straight to Uncle Sam.

And if the feds raised taxes enough to close our massive budget deficit we’d have to work until May 14th (Deficit-inclusion Tax Freedom Day).

Even more depressing, if we go back 112 years to 1900, Tax Freedom Day was January 22nd! At that time, Americans were only forced to pay today about 6% of their income to the government, today it’s almost 30%. But of course that was before Woodrow Wilson and his Progressives took over and started redistributing the wealth.

And we aint’ seen nuthin yet. Barring any intervention by Congress, when “Taxmageddon” arrives next year we can all expect an average tax increase of $3,800. As Heritage’s Curtis Dubay explains:

If Congress fails to act, workers won’t have to wait very long to feel the effects. Every payday, they would see a jump in their payroll tax as it takes a bigger bite out of every paycheck. And that only reflects one of the direct hits they’ll face. They’ll feel the pain of other tax hikes they won’t pay directly, like the health care surtax on investment income and salaries over $250,000 — which begins in 2013 along with five other Obamacare tax hikes — because these hikes will slow job creation by taking away resources from businesses, investors, and entrepreneurs.

It won’t just be the “evil rich” taking the hit either; 70 percent of Taxmageddon’s impact will fall directly on low-income and middle-income families, leaving them with $346 billion less to spend.

I guess maybe we should be celebrating April 17th, 2012. Next year it may just be a nostalgic memory.

~~~~~~~~~~~~

Related:

Tax Burden on American Households ~ Heritage’s “Chart of the Week”