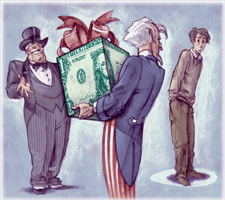

In this happy season of giving aren’t you comforted to know that your taxpayer dollars are being used to ensure a lavish retirement lifestyle for public sector employees? I certainly am. Especially when our personal retirement accounts, the ones we diligently spent years squirreling away, are evaporating right before our very eyes.

In this happy season of giving aren’t you comforted to know that your taxpayer dollars are being used to ensure a lavish retirement lifestyle for public sector employees? I certainly am. Especially when our personal retirement accounts, the ones we diligently spent years squirreling away, are evaporating right before our very eyes.

Not only will many of us never be able to retire completely – we’ll be forced to support our public “servants” for the rest of their lives, in the manner to which they’ve become accustomed.

If you really want to get depressed, visit Taxpayers United of America (TUA). They’ve got all the jaw-dropping numbers. Recently, through the Freedom of Information Act, TUA obtained the gold-plated pension figures for officials in Wayne County, Michigan, along with those for state police, judges and teachers.

How does an annual retirement income of $159,000 sound? With a lifetime payout of $5,741,181? That’s what retired Wayne County health director, Dr. Michele Harris, is set to rake in. And this is in a community with an average annual wage of $55,000 and official unemployment of just under 14%. The county’s annual payout, just for the top 100 pensioners, is around $5.2 million.

The winner in Michigan’s pension-palooza is retiree Albert Lorenzo, former educator, who pulls in $174,617 annually; $6,003,321 total. State judges and police are way down the ladder, their highest annual pensions are under $100,000.

So why are we always hearing the whining about low paid educators? Don’t get me wrong, I personally know many great public school teachers, totally committed to their students. But I agree with Christina Tobin, vice president of TUA who bluntly says that these public pension obligations are simply unsustainable.

At least this issue is starting to get some attention on the national level. Reuters reported last week that ~

Republicans in Congress on Thursday sought to shift attention back to public pension shortfalls, with estimates of the total deficit ranging from $600 billion up to $3 trillion.

Leaders on a joint congressional committee on the economy are releasing a series of reports on states’ struggles to cover the costs of pensions for future retirees.

“States are already $3 trillion in the red, a crisis four times larger than the Wall Street bailout,” said Sen. Jim DeMint of South Carolina, who released the report with Kevin Brady, a Representative from Texas.

DeMint hinted legislation on pensions may be coming soon.

“The deeper we get into this research, the clearer it becomes that federal legislation may be necessary to force states to use honest accounting, fix their pension debt and protect taxpayers from the mother of all bailouts,” he said.

If Senator DeMint is supporting something, you can bet he’s on the Right side of the debate. His website currently features some charts illustrating the looming pension crisis, including the predicted “Day of Reckoning” for each state.

Something’s gotta give folks. The “makers” in this country take all the risks, and in this depressed economy we’re gradually going broke. But the “takers” get a guaranteed life on easy street. Why is the private sector forced to insure a risk-free existence to their “employees?!”

Something’s gotta give folks. The “makers” in this country take all the risks, and in this depressed economy we’re gradually going broke. But the “takers” get a guaranteed life on easy street. Why is the private sector forced to insure a risk-free existence to their “employees?!”

~~~~~~~~~~~~

Ah well, it’s Christmas, and income taxes… they’re just the gifts that keeps on giving – to government employees. Forever…